The kickback against the ‘throw-away’ consumer society is gathering pace, with manufacturers under increasing pressure to stock and supply spare parts. However, the consequences for manufacturers’ fulfilment and packing lines are significant. Jo Bradley, Business Development Manager at Sparck Technologies, explains why.

The ‘Right to Repair’ movement has already seen legislation passed in four US States – California, New York, Colorado, and Minnesota. While, the UK now requires manufacturers of consumer durables such as washing machines, fridges and televisions to supply consumers with spare parts for ‘simple and safe’ repairs, and make parts for trickier jobs available to professional repairers. Support will have to remain available for between seven and ten years.

This brings the UK in line with existing EU rules. But the UK is about to go further. In March 2023 The Commission adopted a proposal on common rules promoting the repair of goods, which are now being discussed. However, importantly, this is with a view to extending coverage beyond consumer durables to other goods, including smartphones and a much wider band of consumer electronics, that may otherwise end up in the WEEE (Waste Electrical and Electronic) waste stream.

Interestingly, some of the American States have started at the other end of the spectrum, on automotive and agricultural equipment, with consumer goods to come later. But it’s almost certain that consumer expectations around repairability across sectors will converge, probably leaving legislation to catch up.

Spare parts fulfilment challenge

For OEMs and their agents, this trend poses many challenges, from product design onwards. One of these is that many will have to establish a comprehensive and complex spare parts operation, in some cases for the first time. Instead of occasionally supplying small numbers of parts, from current products, to official dealers to meet warranty claims, OEMs will need to supply even obsolescent items, not just to dealers, but to third party repairers, the growing number of ‘community’ repair/reuse organisations and, where safety considerations allow, to individual consumers.

And whereas most consumer goods are shipped to the point of sale in their own boxes, perhaps with some foam protectors for the corners, spare parts will require a completely different approach to fulfilment and packaging. Unpredictable combinations of often small, possibly fragile, parts will have to be safely and securely boxed for shipment. Suddenly, OEMs need far more sophisticated packing lines.

Labour costs

Traditional, labour-intensive packing operations are expensive. Businesses that already supply an aftermarket often make reasonable margins on spares, where items can regularly be pulled from production and packaged in occasional periods of relative inactivity. A full-blown, high volume spares operation, likely picking and packing from its own store and inventory, is a different story entirely and may well be a significant commitment in both working capital and labour. Apart from labour costs, think of all the multitude different box sizes that will need to be kept in stock and the consequences of not having the right sized box available to packers.

Automation can be deployed to reduce labour costs in the packing operation. However, merely automating the piling of parts into any available box with some void-fill won’t do. Not only are small components liable to get lost amongst the crumpled paper or styrene beads, or damaged as they shake about, but the profile of consumer most likely to demand repairability and sustainability is the least likely to be impressed by spares arriving in oversized boxes, with all the waste of carboard and other materials this implies.

‘Right-sizing’ boxes

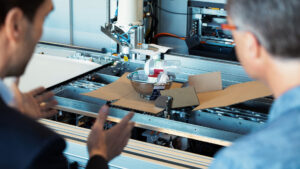

Luckily for businesses serving the parts market, advanced packaging technology is now available that can ‘right-size’ boxes for single or multiple item orders. These machines automatically scan an order and produce the optimum sized box at great speed – going a long way to controlling costs.

Sparck Technologies’ CVP Impack and CVP Everest machines do exactly that. These machines calculate the optimum shape and size of box required, which is then automatically cut, creased, erected, sealed, weighed and labelled. With the capacity to generate over 40 million unique box sizes, this equips companies with the agility and flexibility as they navigate future legislation and demand. The highest-volume machines can make up to 1,100 boxes per hour – an equivalent throughput on manual packing lines may take up to 20 staff. Usefully for this sector, ultra-low profile boxes of just 28mm can be created.

Right-sizing typically saves 30% or more in cardboard, besides eliminating void-fill, so meeting consumer expectations on sustainability. Right sizing also generates significant economies in transport and post/courier charges.

The demand for repairability will only grow. Businesses can prepare for these changes and capitalise on the opportunities, not just to reduce costs but to secure competitive and reputational advantage.